Your state might receive plenty of sunlight, but that doesn’t make it the perfect place to go solar. In fact, we found most states are coming up short.

Why even consider solar in the first place? If we are to ever meet our climate goals, we need to lower our reliance on fossil fuels. Our nation’s power grid is stressed and aging, leading to more frequent outages and rising electricity rates. In fact, a recent CNET survey found 78% of Americans are stressed about rising home energy costs. If you’re trying to lower your electric bill, you have a few choices.

But while slapping solar panels on your rooftop is a widely accepted solution to the problem, solar panels systems just aren’t affordable for many Americans. Even after applying the 30% federal solar tax credit, the price tag of a residential solar system still averages $20,000. Since the median balance in an American bank account is only $8,000, the math isn’t mathing for the solar-curious.

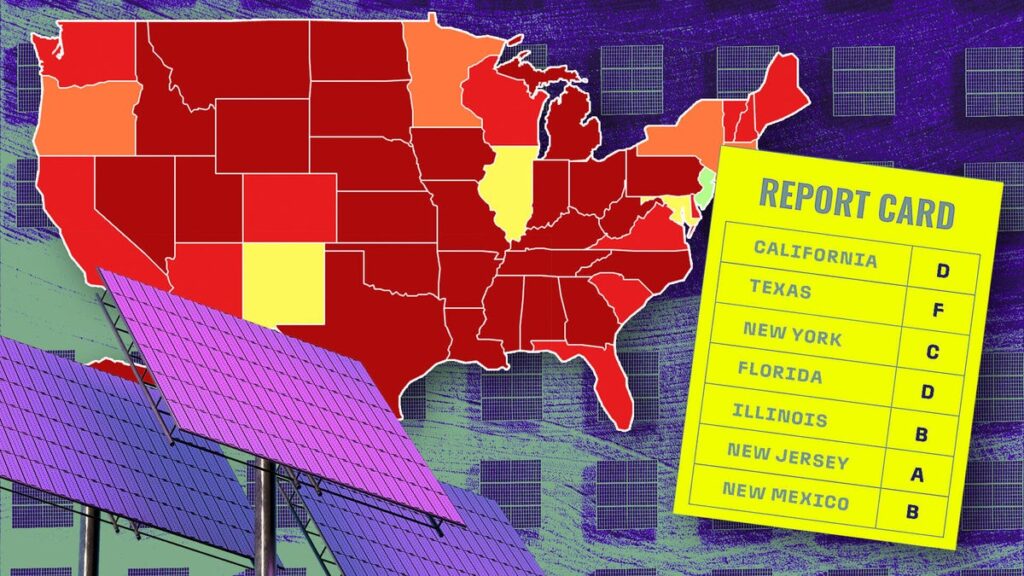

It’s time for states to step it up. To bring the issue front and center, we gave each state a letter grade based on how solar-friendly it is. And we aren’t talking about sunshine — we’re talking about solar policy: the laws and regulations that incentivize residential solar panel installation and adoption in a state.

Your state’s government chooses its solar policies and has a direct impact on the accessibility and affordability of rooftop solar. State incentives such as tax credits, property and sales tax exemptions, community solar access and net metering policies all factor in your state’s solar-friendly grade.

State solar tax credits, for example, offer a credit on your state income tax, while incentives like net metering and SREC programs offer compensation for the solar energy you generate. Your state might offer property and sales tax exemptions for solar panel systems as well, protecting you from a sudden spike in property taxes and saving you a bit on the purchase of the equipment. We also took into account each state’s total investment in its solar industry, offering a glimpse at the maturity of the solar industry in that state.

We scored and graded each state on its policies and available incentives. Here’s how each state fared on CNET’s solar policy exam.

Solar policy grades by state

There are a handful of states that are doing a great job crafting solar policy that makes it affordable and accessible for homeowners and renters alike to go solar. No state has created the perfect set of legislative conditions that make it easier or cheaper for residents to install solar panels, but these are the states that have the best solar incentives right now.

Jump to your state

Incentives available:

- Potential SREC earnings worth more than $200

- Retail rate net metering

- Solar panel systems fully exempt from property taxes

- Solar panel systems fully exempt from sales tax

- Statewide community solar programs

- Low-income solar programs available

Strongest scoring categories:

New Jersey offers some of the most important incentives when it comes to lessening the solar payback period with retail net metering and full property and sales tax exemptions. The state also has one of the largest SREC markets in the nation, with some of the highest value energy credits. Community solar programs also make going solar accessible and affordable for renters and households that can’t install solar panels of their own.

Categories to improve:

While New Jersey’s strong SREC market helps provide a significant incentive to go solar, the SREC market can be complicated to navigate for the average consumer. A more straightforward incentive, like a state tax credit, would cause fewer headaches for customers.

2. District of Columbia

Grade: B

Incentives available:

- Potential SREC earnings worth more than $400

- Retail rate net metering

- Solar panel systems fully exempt from property taxes

- Statewide low-income rooftop solar and community solar programs

Strongest scoring categories:

DC’s SREC market helps rooftop solar panel system owners earn back thousands of dollars a year. Low-income rooftop solar and community solar programs also help make the prospect of residential solar much more accessible.

Categories to improve:

While DC has a property tax exemption for solar panel systems, it’s missing a sales tax exemption on the purchase of solar equipment. More importantly, the district is lacking a tax credit to stack with the federal tax credit, which is where consumers see a bulk of their savings.

Incentives available:

- Statewide solar tax credit

- Retail rate net metering (could be compensated at wholesale rate)

- Solar panel systems fully exempt from property taxes

- Solar panel systems fully exempt from sales tax

- Community solar subscriptions available for low-income households

Strongest scoring categories:

New Mexico earned high marks in nearly every category. It is one of the few states to offer a statewide solar tax credit, allowing you to recoup 10% of the cost of your solar system, up to $6,000.

Categories to improve:

The state has a statewide net metering policy, but utilities have a choice on how to compensate you for the energy you sell to the grid. If your system size is 10 kilowatts (10 kW) or less, your utility could choose to compensate you at the wholesale/avoided cost rate.

Incentives available:

- $1,000 capped rebate for solar system installation

- Retail rate net metering

- Solar panel systems fully exempt from property taxes

- Solar panel systems fully exempt from sales tax

- Statewide low-income rooftop solar and community solar programs

Strongest scoring categories:

The Old Line State makes top marks in a lot of the key categories that save homeowners money on their solar installation in both the short term and the long term, including net metering and property and sales tax exemptions. The state also has a large solar carveout in its renewable energy portfolio and a mandate for statewide community solar generation capacity.

Categories to improve:

Maryland has a state tax credit — the $1,000 rebate — which is better than nothing, but it’s still a weak incentive considering a typical solar panel system installation in the state costs tens of thousands of dollars.

Incentives available:

- The Illinois Solar For All and Illinois Shines programs subsidize installation costs

- Retail rate net metering

- Solar panel systems fully exempt from property taxes

- Statewide low-income rooftop solar and community solar programs

Strongest scoring categories:

The Prairie State has a multitude of programs designed to lower solar panel installation costs. Retail rate net metering and a full property tax exemption also help lower the solar payback period for those installing solar in the state.

Categories to improve:

The state doesn’t exempt solar equipment from sales tax. The state could also mandate community solar capacity to ensure more low-income households have an affordable path to solar energy.

Incentives available:

- Per-watt generation grant up to $5,000

- State-governed net metering at fraction of retail rate net

- Solar panel systems fully exempt from property taxes

- Solar panel systems fully exempt from sales tax

- Statewide low-income rooftop solar and community solar programs

Strongest scoring categories:

The energy generation grant (up to $5,000) can save residents a chunk of change on their solar panels.

Categories to improve:

While Rhode Island has statewide net metering, it isn’t offered at the retail rate, which means you’re losing out on precious credits that could help you pull electricity from the grid for free when your solar panels aren’t producing enough to power all of your appliances.

7. Massachusetts

Grade: B

Incentives available:

- Potential SREC earnings worth more than $300

- Tax credit of up to 15% of the solar panel system cost, capped at $1,000

- State-governed net metering at fraction of retail rate

- Solar panel systems fully exempt from property taxes for 20 years

- Solar panel systems fully exempt from sales tax

- Statewide community solar programs

Strongest scoring categories:

With SRECs worth more than $300, the solar energy credit market in Massachusetts will net homeowners several thousand dollars each year. The state also has community solar programs that make switching to solar accessible to anyone.

Categories to improve:

While Massachusetts does have net metering, it isn’t at the full retail rate, meaning residents are missing out on important potential savings. A tax credit of 15% of the solar panel system cost also sounds great, but it’s limited by the relatively low cap of $1,000.

Incentives available:

- Tax credit of up to 25% of the solar panel system cost, capped at $5,000

- State-governed net metering at fraction of retail rate

- Local exemptions on property taxes for solar panel systems

- Solar panel systems fully exempt from sales tax

- Statewide low-income rooftop solar and community solar programs

Strongest scoring categories:

New York has a solid tax credit that could save you thousands of dollars on a purchase that typically costs tens of thousands of dollars.

Categories to improve:

Solar payback periods are slightly longer in New York thanks to the current fractional retail rate net metering policy. Legislators could also craft a law to make solar panels exempt from property taxes statewide.

Incentives available:

- State-governed net metering at fraction of retail rate

- Solar panel systems fully exempt from property taxes

- Statewide low-income rooftop solar and community solar programs

Strongest scoring categories:

Statewide low-income rooftop solar and community solar programs make going solar more affordable and accessible for renters and homeowners alike, and solar panels are fully exempt from property taxes in Oregon.

Categories to improve:

Residents are missing out on crucial net metering savings, since they’re only being offered a fraction of the retail rate — although having net metering at all is still better than what other states might offer. More importantly, there are no state tax credits in Oregon, which means there’s less of a reprieve from the damage that initial solar equipment purchases will be doing to wallets statewide.

Incentives available:

- State-governed net metering at fraction of retail rate

- Solar panel systems fully exempt from property taxes

- Solar panel systems fully exempt from sales tax

- Statewide community solar programs

Strongest scoring categories:

All solar equipment that you might buy for your solar panel systems is fully exempt from property and sales taxes in Minnesota. Community solar programs exist statewide so that renters and homeowners can subscribe to solar and pay less for their electricity.

Categories to improve:

Minnesota is completely lacking in a state solar tax credit and also doesn’t offer retail rate net metering. While there are community solar programs statewide, no other low-income solar programs are on offer.

Incentives available:

- State-governed net metering at fraction of retail rate

- Solar panel systems fully exempt from property taxes

- Solar panels fully exempt from sales taxes — not applicable to other solar equipment

- Statewide low-income rooftop solar and community solar programs

Strongest scoring categories:

Colorado has statewide low-income rooftop solar and community solar programs, which makes it another state that has opened up affordable and accessible options to get solar energy for more homes. Solar equipment is also fully exempt from property taxes in the state, while only the solar panels themselves are exempt from sales taxes.

Categories to improve:

No state solar tax credit means the initial investment into solar will cut deeper into residents’ wallets, and net metering at a fraction of the retail rate will extend the solar payback period before Coloradans start seeing savings on that investment.

(Tie) 12. Connecticut

Grade: D

Incentives available:

- State-governed net billing — solar buyback at the wholesale rate

- Solar panel systems fully exempt from property taxes

- Solar panel systems fully exempt from sales tax

- Low-income and community solar programs (local or utility-administered)

Strongest scoring categories:

Solar panel systems with all of their bells and whistles are fully exempt from property and sales taxes in Connecticut. There are also low-income and community solar programs, but they’re on a local level and may not necessarily be available to every resident of the state.

Categories to improve:

Connecticut’s net billing means you’ll be getting the short end of the stick when it comes to saving money by sending your energy back to the grid. There’s also no state solar tax credit to ease the financial burden of the initial investment into solar energy.

(Tie) 12. South Carolina

Grade: D

Incentives available:

- State tax credit of up to 25% of the solar panel system cost, capped at $35,000

- State-governed net billing — solar buyback at the wholesale rate

- Solar panel systems fully exempt from property taxes

Strongest scoring categories:

South Carolina has one of the strongest state solar tax credits, letting residents save an additional 25% on the cost of the solar panel system — stacking on top of the 30% federal tax credit.

Categories to improve:

Other than the phenomenal state solar tax credit, there aren’t many great incentives for going solar in South Carolina. There are no sales tax exemptions for solar panel systems, net billing means residents are missing out on important savings that could shorten their solar payback periods and a lack of low-income rooftop solar and community solar programs means it isn’t affordable nor accessible for most folks in the state to switch to solar energy.

Incentives available:

- Retail rate net metering

- Solar panel systems fully exempt from property taxes

- Statewide community solar programs

Strongest scoring categories:

Virginia’s retail rate net metering will aid residents in shortening their solar payback periods. Solar panel systems are also fully exempt from property taxes, but not state sales taxes.

Categories to improve:

There’s no state solar tax credit to speak of in Virginia, and no low-income programs outside of community solar.

Incentives available:

- State tax credit worth 25% of the cost of your solar system, up to $1,000

- State-governed net billing — solar buyback at the wholesale rate

- Solar panel systems fully exempt from property and sales taxes

- Low-income and community solar programs (local or utility-administered)

Strongest scoring categories:

Solar panel systems are fully exempt from both property and sales taxes in Arizona. While net billing gives you crummy energy buy back rates, it’s still better than nothing.

Categories to improve:

The net billing policy and the low-income and community solar programs only being offered at a local-level rather than across the state are both half measures in their respective categories.

Incentives available:

- State-governed net billing — solar buyback at the wholesale rate

- Solar panel systems fully exempt from property taxes

- Statewide low-income rooftop solar and community solar programs

Strongest scoring categories:

California offers a bevy of low-income programs across the state, helping make all solar equipment — including whole home batteries — more affordable. The whole solar panel system is also fully exempt from property taxes in the state.

Categories to improve:

The NEM 3.0 policy has put a real damper on the savings California residents were able to generate from net metering. Whereas Californians once had a great net metering deal, they now have something more akin to net billing at the wholesale rate, hurting solar payback period projections for new solar panel owners across the state.

(Tie) 17: New Hampshire

Grade: D

Incentives available:

- Retail rate net metering

- Solar panel systems only fully exempt from property taxes in certain local areas

- Statewide community solar programs

Strongest scoring categories:

New Hampshire’s retail rate net metering will greatly shorten the solar payback period for residents with solar panels. Statewide community solar programs also make the switch to solar energy easier.

Categories to improve:

New Hampshire has no state solar tax credit and no statewide solar panel system exemption from property taxes.

(Tie) 17. Puerto Rico

Grade: D

Incentives available:

- Territory-governed net metering at the retail rate

- Solar panel systems fully exempt from property taxes

- Solar panel systems fully exempt from sales tax

- Territory-wide low-income programs

Strongest scoring categories:

Solar panel systems and all of their associated equipment are fully exempt from both property and sales taxes in Puerto Rico. Additionally, the territory’s Solar Access Program provides 30,000 households with solar panels at no upfront cost.

Categories to improve:

There’s no solar tax credit in Puerto Rico.

(Tie) 17: Delaware

Grade: D

Incentives available:

- Retail rate net metering

- Statewide low-income rooftop solar programs

Strongest scoring categories:

With retail rate net metering, Delaware residents will have shorter solar payback periods. The low- to moderate-income solar program in the state will pay off 70% of a system up to 6 kW in size for qualifying applicants.

Categories to improve:

Though the First State has a solid low-income solar program, it’s missing many of the other incentives that lower the financial barrier to entry for residential solar. Legislation regarding a state solar tax credit, a property tax exemption or community solar would be a great next step toward expanding state solar-friendliness in Delaware.

(Tie) 17: Wisconsin

Grade: D

Incentives available:

- State-governed net metering where utilities choose exchange rates

- Solar panel systems fully exempt from property taxes

- Solar panel systems fully exempt from sales tax

- Statewide community solar programs

Strongest scoring categories:

Residential solar panel systems installed in Wisconsin are fully exempt from property and sales taxes. The state also has special legislation regarding net metering, offering utilities choices on what energy exchange rates to offer. You might get the retail rate, but it’s not guaranteed.

Categories to improve:

Wisconsin has no state solar tax credit to speak of, which means residents are taking on a rather large financial burden up front when investing in solar panels.

Incentives available:

- Retail rate net metering

- Solar panel systems fully exempt from property taxes

Strongest scoring categories:

Retail rate net metering means Mainers are getting some of the best exchange rates when it comes to sending their generated energy back to the grid. Solar equipment is also fully exempt from property taxes.

Categories to improve:

The state is missing a solar tax credit that could be stacked on the federal one, creating big savings to incentivize a switch to solar.

(Tie) 21: Vermont

Grade: D

Incentives available:

- State-governed net metering at fraction of retail rate

- Solar panel systems fully exempt from property taxes

- Solar panel systems fully exempt from sales tax

- Community solar programs (local or utility-administered)

Strongest scoring categories:

The biggest incentives in Vermont are the full exemptions for property and sales taxes on solar equipment. Community solar subscriptions are a cheap and accessible way for residents to benefit from solar, but they’re not run statewide and so certain residents won’t have access to them.

Categories to improve:

Vermont is missing a state solar tax credit, which is potentially the most important state solar incentive there is, but there’s also not really any legislation supporting low-income solar access within the state.

Incentives available:

- Retail rate net metering

- Solar panel systems fully exempt from sales taxes

- Statewide community solar programs

Strongest scoring categories:

Washington residents have the best exchange rate on electricity with retail rate net metering, and solar equipment within the state is fully exempt from any sales tax. Community solar programs allow renters and homeowners alike to pull energy from solar panels for a fee statewide.

Categories to improve:

Washingtonians have no access to a state solar tax credit, and there are no other low-income solar programs in the state to make residential installation more accessible. The state also doesn’t exempt solar panel systems from property taxes, which is going to be a hit to solar savings year after year.

Incentives available:

- State tax credit of up to 35% of the solar panel system cost, up to $5,000. System must be at least 5 kW.

- Utility-governed net billing — solar buyback at the wholesale rate

- Local property tax exemptions on solar panel systems

- Statewide community solar programs

Strongest scoring categories:

Hawaii’s state tax credit isn’t the best of the bunch, but it’s a solid value add for anyone looking to go solar. Residential systems are more often than not going to hit that 5 kW mark necessary for the credit, and it’s a good deal to be able to stack an additional $5,000 on the 30% federal tax credit.

Categories to improve:

Utility-governed net billing means the utility companies are going to have the final say in the exchange rate for your excess electricity, and that wholesale rate is going to set back your solar payback period. Hawaii also has no state sales tax exemption on solar equipment, and property tax exemptions are only offered in certain local areas.

Incentives available:

- Retail rate net metering

- Property tax exemption of 80% of the value of the solar panel system

- Solar panel systems fully exempt from sales taxes

Strongest scoring categories:

The Sunshine State’s best incentive is hands down retail rate net metering, meaning that you can exchange your excess energy on the grid and get credits to pull energy back off of the grid later on at the same rate.

Categories to improve:

Florida is completely missing a state tax credit, community solar and low income programs — those would be a good next step for codifying future incentives.

Incentives available:

- State-governed net metering at fraction of retail rate

- Solar panel systems fully exempt from property taxes

- Solar panel systems fully exempt from sales tax

Strongest scoring categories:

Full tax exemptions are the best state incentives in Ohio. If you’re looking at installing a residential solar panel system within the state, a full property and sales tax exemption will ease the financial burden of a substantial five-figure initial investment.

Categories to improve:

While Ohio’s net metering is better than net billing, you’re still not getting accredited 1:1 for the excess energy you send back to the grid.

27. North Carolina

Grade: F

Incentives available:

- State-governed net billing — solar buyback at the wholesale rate

- Property tax exemption of 80% of the value of the solar panel system

Strongest scoring categories:

The property tax exemption in North Carolina will shave some money off of the initial cost of going solar, though you’ll still have to pay 20% of the normal property taxes on your solar panel system.

Categories to improve:

North Carolina’s property tax exemption certainly isn’t perfect, but the net billing at the wholesale rate is going to hurt residents’ savings even more. The state is also completely missing a sales tax exemption on solar panel systems, which might be a good first step for improving state solar incentives.

Incentives available:

- Retail rate net metering

- Solar panel systems fully exempt from property taxes

Strongest scoring categories:

When it comes to the state solar incentives Michigan does have, the state doesn’t skimp on quality. Retail rate net metering and a full exemption from property taxes for solar panel systems are the best versions of those respective incentives.

Categories to improve:

Though Michigan’s current incentives are good, the state just doesn’t have many incentives at the moment. Branching out and nailing down legislation for a sales tax exemption, a state solar tax credit, community solar programs or low-income solar programs would be a good next step in committing to solar-friendly policy.

Incentives available:

- Retail rate net metering

- Solar panel systems exempt from $20,000 of property taxes for 10 years

Strongest scoring categories:

Montana offers retail rate net metering, which means you’re getting credited 1:1 for the energy you’re sending off to the grid. The state also has a property tax exemption, but it’s limited by length of time and amount of money. At the end of the day, you’re not fully off the hook when it comes to paying taxes, even if Montana doesn’t have sales tax.

Categories to improve:

The property tax exemption in Montana could definitely be improved; many states offer a full property tax exemption on solar panel systems. Additionally, the state could mandate community solar programs and other low-income solar programs to make it easier for low- and middle-class homeowners and renters to go solar.

Incentives available:

- Initial 40% income tax deduction for a solar panel system, with a 20% deduction each year for the next three years. Maximum yearly deduction of $5,000; maximum total deduction of $20,000.

- Utility-governed net billing — solar buyback at the wholesale rate

Strongest scoring categories:

A massive state solar tax credit will help residents recoup much of the cost of their solar panel system through income tax rebates. While this tax credit depends on having a high enough income tax liability to take advantage of it, a maximum total deduction of $20,000 is enough to cover a substantial amount of the cost of a solar panel system.

Categories to improve:

It’s never good to see utility-governed net billing; leaving the credits for sending energy to the grid in the hands of the utility companies means residents are going to see unfavorable rates, increasing their solar payback periods. While Idaho has a fantastic solar tax credit, it’s also missing other basic state incentives, such as a property and sales tax exemption on solar panel systems.

Incentives available:

- State-governed net metering at fraction of retail rate

Strongest scoring categories:

Nevada has state-governed net metering at a fraction of the retail rate, which means you’re getting a better deal than the wholesale rate offered with many net billing policies. The state also has a community solar mandate, though no substantial programs are built out quite yet.

Categories to improve:

Nevada is missing some easy state solar policies that could bump up its state solar friendliness and make it easier for residents to get solar panel systems. The easiest first steps would be legislating property and sales tax exemptions for solar panel systems and making good on that community solar mandate.

Incentives available:

- State-governed net billing — solar buyback at the wholesale rate

- Solar panel systems fully exempt from property taxes

- Only solar arrays fully exempt from sales tax

Strongest scoring categories:

In Indiana, solar panels are fully exempt from property taxes. Only the solar arrays themselves are exempt from sales taxes, rather than every piece of solar equipment, but the combined tax exemptions can save residents on the investment into a solar panel system.

Categories to improve:

The exchange rate for energy on the grid is accredited at the wholesale rate, which is going to impede residents’ savings. There are also no low-income programs for solar offered in Indiana.

Incentives available:

- State-governed net billing — solar buyback at the wholesale rate

- Solar panel systems fully exempt from property taxes

Strongest scoring categories:

The best state solar incentive in Louisiana is a full exemption on property taxes for solar panel systems. There’s also net billing at the wholesale rate, which isn’t as good as net metering at the retail rate — but it’s better than not being credited for exchanging your excess generated energy on the grid at all.

Categories to improve:

Louisiana is missing a sales tax exemption on solar panel systems, which could save residents hundreds of dollars when switching to solar. There are also no low-income or community solar programs available in the state.

Incentives available:

- State-governed net metering at fraction of retail rate

- Local property tax exemptions on solar panel systems

Strongest scoring categories:

While you aren’t going to get credited 1:1 for sending your excess energy to the grid in Alaska, you do get a fraction of the retail rate rather than the wholesale rate. There are also local exemptions on property taxes, but this depends on where you live and it is by no means a statewide incentive.

Categories to improve:

Alaska has no state solar tax credit, nor does the state have any low-income solar programs or community solar programs for homeowners and renters.

Incentives available:

- Utility-governed net billing — solar buyback at the wholesale rate

- Solar panel systems fully exempt from property taxes

Strongest scoring categories:

You don’t have to worry about paying property taxes on solar panel systems in Texas, which significantly eases the financial burden of the initial investment. Net billing at the wholesale rate isn’t great, but it’s better than nothing.

Categories to improve:

Some good first steps for solar friendly legislation in Texas would be bringing that net billing policy up to 1:1 net metering at the retail rate, helping residents pull out the same amount of electricity that they feed into the grid. A full sales tax exemption on solar equipment would be another good step to take before looking at other potential state incentives.

Incentives available:

- Utility-governed net billing — solar buyback at the wholesale rate

- Solar panel systems fully exempt from property taxes for five years

- Solar panel systems fully exempt from sales tax

Strongest scoring categories:

While Iowa has a full property tax exemption, it’s only for the first five years after you have your solar panel system installed. This will save you a chunk of change in the short term, but you’ll have to pay those property taxes after that five year period runs out.

Categories to improve:

A full property tax exemption with no time limit would be a decent improvement. State-governed retail rate net metering would accelerate solar payback periods across the state.

Incentives available:

- Utility-governed net billing — solar buyback at the wholesale rate

- Solar panel systems fully exempt from property taxes

Strongest scoring categories:

If you’re a homeowner installing rooftop solar in Alabama, you’re not going to have to worry about property taxes on that solar panel system. You’ll also be able to exchange your excess energy on the grid, but only at the wholesale rate, which will set back your savings compared to retail rate net metering.

Categories to improve:

Alabama is missing a sales tax exemption on solar panel systems, and it’d be much better if the state codified retail rate net metering.

38. Pennsylvania

Grade: F

Incentives available:

Strongest scoring categories:

Pennsylvanians are going to be credited 1:1 at the full retail rate when exchanging their excess energy with the grid, which is going to help accelerate their solar payback period and help them start saving money after recouping their initial investment much more quickly.

Categories to improve:

A good first step might be a property and sales tax exemption for solar panel systems, but other bigger steps would include low-income rooftop solar programs, community solar programs and a state solar tax credit.

Incentives available:

- State-governed net metering at fraction of retail rate

- Solar panel systems fully exempt from property taxes for 10 years

Strongest scoring categories:

Kansas homeowners who install solar panel systems have a full exemption from property taxes, but only for the first 10 years post-installation. There’s also fractional net metering that’ll let solar panel system owners exchange their excess electricity, though not for 1:1 credit at the retail rate.

Categories to improve:

Kansas offers no sales tax exemption on solar panel systems, no state solar tax credit, no low-income programs and no community solar programs.

(Tie) 40. Arkansas

Grade: F

Incentives available:

Strongest scoring categories:

Arkansas offers net metering at the full retail rate, allowing solar panel system owners to exchange their excess electricity on the grid for credits to pull from the grid when their solar panels aren’t producing enough energy for the household.

Categories to improve:

Though retail rate net metering is a very strong policy, Arkansas has nothing else in the way of solar incentives. The state has no property or sales tax exemptions, state solar tax credits, low-income rooftop solar programs or community solar programs.

(Tie) 40. Tennessee

Grade: F

Incentives available:

- Utility-governed net billing — solar buyback at the wholesale rate

- Exemption on property taxes exceeding the value of 12.5% of the total installed cost of the solar panel system

Strongest scoring categories:

If you live in Tennessee, you’ll be getting a little bit of cash back for sending your excess energy to the grid. But at the wholesale rate, you won’t exactly be lining your pockets with dollar bills. Additionally, the state offers an exemption on property taxes, but you’ll still have to pay up taxes on 12.5% of the worth of your solar panel system.

Categories to improve:

A good start for Tennessee could be bringing those existing incentives up to par with other states, reworking the solar buyback program to retail rate net metering and creating a full property tax exemption for solar panel systems.

42. West Virginia

Grade: F

Incentives available:

Strongest scoring categories:

West Virginia’s single incentive is on par with the best states. Retail rate net metering means that you’ll be getting the best possible credit for sending your excess generated electricity to the grid, which will help reduce your solar payback period.

Categories to improve:

Aside from net metering, West Virginia doesn’t offer any state solar incentives. A good place to start could be offering some of the common tax breaks that other states have available for solar panel system owners.

43. South Dakota

Grade: F

Incentives available:

- Solar panel systems exempt from 70% of property taxes (up to a cap of $50,000)

Strongest scoring categories:

South Dakota offers a large exemption on property taxes, helping tamp down costs over time by up to five figures. It’s not a full exemption, but it will shave off the majority of the property taxes you have to pay.

Categories to improve:

A full exemption on property taxes would be a quick and easy way to improve state solar incentives. South Dakota is also missing any type of net metering program — the state doesn’t even have a solar buyback program offering an exchange at the wholesale rate. This is an absolutely crucial incentive, and it would be the best place to start building out more state incentives.

Incentives available:

- State-governed net billing

Strongest scoring categories:

While Missouri doesn’t offer retail rate net metering, and instead offers an electricity exchange at the wholesale rate, the program is governed by the state instead of the utilities.

Categories to improve:

Bringing the electricity exchange up to par and codifying state-governed net metering would be the crucial first step to building out Missouri’s state incentives. State tax breaks and even a state tax credit would be the easiest next steps after that.

45. North Dakota

Grade: F

Incentives available:

- State-governed net billing

- Solar panel systems fully exempt from property taxes for five years

Strongest scoring categories:

Solar panel system owners are able to get credited for exchanging their excess electricity on the grid in North Dakota, but they’re going to be making that trade at the wholesale rate. Solar panel systems are fully exempt from all property taxes, though that exemption only lasts for five years post-installation.

Categories to improve:

The easiest improvements would be to institute retail rate net metering and bring that energy exchange up to a 1:1 credit for what gets sent to the grid, as well as fully exempting solar panel systems from property taxes.

Incentives available:

- State-governed net metering at fraction of retail rate

Strongest scoring categories:

Kentucky’s net metering program is better than some higher-ranked states. When Kentucky residents send excess electricity to the grid, they’re getting credited at a rate that’s higher than the wholesale rate — but they’re also not getting credited at a 1:1 rate, either.

Categories to improve:

Kentucky’s net metering policy would be improved by offering a retail rate exchange. Any additional incentives would also be an improvement, whether it be tax exemptions, a state tax credit, community solar or low-income solar programs.

(Tie) 47. Georgia

Grade: F

Incentives available:

- Utility-governed net metering

- Local or utility-administered low-income rooftop solar and community solar programs

Strongest scoring categories:

Georgia doesn’t have state-governed net metering, which means it’s up to your utility to decide what kind of rate you’re getting — but net metering does exist within the state. More importantly, the Peach State has low-income and community solar programs that help make switching to solar accessible and affordable.

Categories to improve:

While utility-governed net metering isn’t the worst possible deal, it’d be better if the state stepped in to mandate retail rate net metering. The creation of a state tax credit and the exemption of property and sales taxes on solar panel installations would likely be the logical next steps to make the state more solar friendly.

Incentives available:

- State-governed net billing

Strongest scoring categories:

Utah edges out the lowest scoring states in the rankings due to a much higher per capita investment in the solar industry. At the end of the day, that doesn’t translate to more incentives for residents looking to go solar — Utah only offers state-governed net billing to those making the solar switch.

Categories to improve:

While Utah might rank slightly higher than the bottom scorers, it faces all of the same problems when it comes to state solar incentives. The Beehive State could improve by creating a state solar credit, legislating state-governed retail rate net metering, instituting property and sales tax exemptions or ensuring that low-income solar programs are available statewide.

(Tie) 49. Wyoming

Grade: F

Incentives available:

- State-governed net billing

Strongest scoring categories:

Wyoming only offers state-governed net billing. This means you’re not getting anything close to the retail rate when you participate in a solar buyback program sending your energy to the grid.

Categories to improve:

There are a lot of things Wyoming can do to become a more solar-friendly state. Some of the simplest legislative actions would be to instate a state-governed retail rate net metering policy and exempt solar panel installations from property and sales taxes statewide.

(Tie) 49. Mississippi

Grade: F

Incentives available:

- State-governed net billing

Strongest scoring categories:

Mississippi also only offers state-governed net billing, which similarly means that residents installing solar panels in the state aren’t getting the retail rate for sending their energy to the grid. This will significantly increase the solar payback period for anyone installing solar in the state.

Categories to improve:

One important category to improve would be the creation of a state solar tax credit. Solar panel systems cost a lot of money, and while the 30% federal tax credit helps cover some of that cost, a state tax credit shows a real commitment to solar energy.

(Tie) 49. Oklahoma

Grade: F

Incentives available:

- State-governed net billing

Strongest scoring categories:

Tied with Wyoming and Mississippi at the second lowest scoring spot, Oklahoma only offers state-governed net billing. Oklahoma residents won’t be able to earn credits to pull energy from the grid at the retail rate, pushing back the timeline for solar savings.

Categories to improve:

Another category for the lowest scorers to improve upon would be making solar more accessible for all state residents. Community solar mandates and low-income solar programs help ensure that solar isn’t limited to high earners.

Incentives available:

- State-governed net billing — solar buyback at the wholesale rate

Strongest scoring categories:

The only incentive in Nebraska is net billing. Much like with net metering, net billing is a “buyback” of the energy generated by your solar panels, wherein you can gain credits to pull energy from the grid. Unfortunately, net billing programs only offer the wholesale exchange rate, which means you’re losing out on a ton of potential savings.

Categories to improve:

Nebraska could improve by offering any of the other common solar-friendly incentives. A great first step would likely be to institute property and sales tax exemptions for solar equipment. In the future, a more solid commitment to solar could be affirmed by creating a state tax credit and funding low-income solar programs.

How we evaluated each state

We score each state by running it through our methodology, containing eight categories. Each category is given its own weight. The higher the weight, the higher the impact it has on the average consumer. Each state receives an individual score in each category. The category scores are then averaged to receive its final score, which is then converted to a letter grade.

Originally, we graded on a standard 10-point scale. But because most states scored so low, we added a grading curve. Only one state scored high enough to even receive an A. Through this project, it became clear to us that state governments still have a long way to go in making residential rooftop solar more accessible.

These are the categories and their weights:

- State solar tax credit (or equivalent incentive): 25%

- Net metering: 15%

- Property tax exemption: 15%

- Sales tax exemption: 10%

- Community solar policy: 10%

- Low-income solar program availability: 10%

- Renewable portfolio standards: 10%

- Total investment in solar per capita: 5%

For a more in-depth look at how we scored each state, you can read more about our methodology here.

Common types of solar incentives

State governments and local utilities offer a variety of different incentives to help you pay for solar panels. Net metering, tax exemptions and rebates are the most common. But there are additional incentives out there for apartment dwellers and low-income households as well. You’ll even be able to combine most of these incentives with the federal solar tax credit too. Here are some of the most common solar incentives you might find in your state.

State solar tax credits

Some states offer solar tax credits separate from the federal solar tax credit –but not as upfront cash. Solar tax credits are usually offered as a state income tax credit, offsetting the amount you owe in taxes for the year, up to a certain amount. If you don’t owe enough in state taxes for the year, some states will let you roll the remaining credit over to future tax years. These state tax credits could save you thousands on a residential solar panel system.

Currently, the only states offering their own solar tax credits are Arizona, Hawaii, Idaho, Maryland, Massachusetts, New Mexico, New York, Rhode Island and South Carolina. And while Illinois technically doesn’t offer a state solar tax credit, we saw their statewide solar incentives as a decent equivalent. However, some tax credits are much better than others. A few stand-out states are South Carolina, Idaho and Illinois.

Illinois has two excellent state solar programs: Illinois Shines and Illinois Solar for All. The Illinois Shines program is open to all residents in the state, and provides upfront funding for 15 years of renewable energy credits. This could potentially cover a third of the cost of your solar system. Illinois Solar for All covers the upfront costs of going solar for any household whose income is below 80% of the area median income.

South Carolina’s tax credit offers 25% of the cost of your solar system, up to $35,000 or 50% of your tax liability for the year. The state of Idaho offers a 40% tax deduction on the cost of a solar system, applied on the year of installation. You’ll get a 20% deduction for the next three years.

Net metering

Net metering is the most common state solar incentive. These programs are either run by the state or the local utilities. Net metering programs allow you to sell any excess electricity generated by your solar panels to the power grid. You’ll either be compensated in cash or bill credits. There are only three states that don’t have net metering or net billing: South Dakota, Tennessee and Alabama.

If your state doesn’t have a “net metering” program, it might have net billing, which is a similar concept, except you’re compensated less for the solar energy you sell to the grid.

With net metering, the utility buys your excess energy at the retail electricity rate, meaning its buying it at a price you would see on your bill for a kilowatt-hour you buy. When you sell your excess energy to the grid through a net billing program, the utility buys it from you at a wholesale rate (or avoided cost rate), which is the price the utility buys energy from the electricity supplier. This is usually much lower than the retail rate.

State property and sales tax exemptions

Sales and property tax exemptions for solar panels are a fairly common incentive that states will offer. Installing solar panels on your property increases your property value. When it comes time for the local government to reassess your property value, your property taxes could go up. To prevent this, some states have a property tax exemption in place. This doesn’t mean you won’t be paying property taxes anymore, but that the value of the solar panels won’t be counted toward your property tax assessment.

State sales tax exemptions for solar are pretty simple — any solar equipment for your system is exempt from the local sales tax. This includes things like your solar panels, inverter, racking and power optimizers. The savings from this will depend on what the sales tax rate is in your state. Some states don’t have any, while others have sales tax rates near 10%.

Community solar

If you live in an apartment or can’t afford the cost of installing solar panels on your own home, there are other ways to power your home with renewable energy. With a community solar program, the electricity that powers your home comes from a local offsite solar farm. The electricity generated by the solar farm goes through the local utility and is then sent to the subscribers of the community solar program. The price you pay for your electricity with community solar is typically lower than the retail electricity rate from the utility.

Community solar programs are great but often have very limited availability. There are only a certain number of subscriber slots available and they fill up quickly. Many community solar programs have a waitlist you can join. Some programs reserve a certain number of spots just for middle to low-income households or even offer a cheaper rate than the normally offered community solar electricity rate.

Solar incentives for low-income households

Some states offer additional incentives for households that are considered low- or moderate-income. Most of these incentives are programs that offer to assist low-income and disadvantaged communities with the cost of going solar. Some programs might even claim to offer free solar panels, but make sure to read the fine print.

One common low-income solar program is the Solar for All program, funded by the US Environmental Protection Agency. This program provides grants and funding for states to put toward helping low-income households with the cost of installing rooftop solar on their homes.

The EPA announced this year that $7 billion of the money allocated to its Greenhouse Gas Reduction Fund would be distributed to grantees nationwide who could provide clear plans as to how it would create low- and middle-income or community solar programs in their chosen states or territories. Grantees were chosen in April 2024. While the grantees’ plans encompass all 50 states and the US territories, it’s only just been announced and has yet to start taking applications. We aren’t factoring these programs into our scoring until it starts accepting customers.

Rural Energy for America Program (REAP)

The Rural Energy for America Program (REAP) is a federal incentive program that provides grants and loan guarantees for energy efficiency improvements to agricultural producers and rural small businesses. Funds from this program can be used toward installing renewable energy systems like solar panels and wind turbines.

These funds can also be used to install energy efficiency improvements on your property, like new HVACs, insulation, lighting and more. Farms and rural small businesses could receive grants covering up to 50% of total eligible project costs. REAP also offers loan guarantees of up to 75% of total eligible project costs.

Solar renewable energy certificates (SRECs)

SRECs provide another way for you to make money off your solar energy by selling it to the utility. Some states have renewable energy portfolio (REP) standards to meet, a policy that requires electric utilities to provide a certain amount of power from renewable sources. In order to meet their REP goals, utilities will trade renewable energy certificates (RECs) on an open market.

A single REC is one megawatt-hour of energy generated from a renewable source. An SREC is basically a REC that was generated from solar. These RECs act as proof that the utility companies are meeting their renewable energy portfolio requirements. It doesn’t matter where the energy comes from, just as long as utilities have it.

The local utility will buy your SRECs and trade them with other utility companies on a sort of REC market. These SRECs will be sold to the highest bidder. Some states will let you participate in net metering and sell SRECs at the same time. Certain utilities also assist you with the cost of going solar, as long as you agree to participate in the local SREC market.

Massachusetts, New Jersey and Washington, DC, have particularly robust SREC markets, capable of potentially earning you thousands over the lifetime of your solar system. However, SREC markets can be tricky to navigate. You might need to go through a broker or a third party to sell your RECs. And you’ll likely be charged a broker’s fee.

Rebates

Some local governments and utilities will offer rebates for solar panel systems and batteries. Every rebate is a bit different, but most follow a similar sort of pattern. The state or utility will assist with the cost of installing solar panels or a battery, as long as you take a certain action.

The most common ones are:

- Signing up for a specific solar buyback program.

- Installing a solar panel system of a specific size on your property.

- Installing a specific type of solar panel system or battery on your property.

- Completing a solar education program or course and then installing solar panels on your property.

- Simply installing solar on your property.

The state of Texas in particular, has many utility-run rebates. However, many of these rebates are dependent on where you live and which utility providers service your area.

What is the federal solar tax credit?

The federal solar tax credit, also known as the residential clean energy credit, is a tax rebate available to all US residents who invest in clean energy additions to their homes.

In 2020 and 2021, the tax credit provided a 26% rebate on the cost of clean energy equipment. This credit was bolstered within the Inflation Reduction Act, a piece of legislation passed by Congress in August 2022.

Since the passage of the IRA, the residential clean energy credit provides a 30% rebate on the cost of any eligible clean energy home installations once tax season rolls around. The list of eligible installations is extensive, and it does include solar panels and solar batteries.

You need to have taxable income to take advantage of this incentive, but if you can’t claim the full tax credit in one go, it does roll over to the next year.

The Inflation Reduction Act set aside almost $369 billion for clean energy equipment and home energy efficiency improvements across the country, but that doesn’t mean you need to take advantage of this incentive right away.

The 30% rebate residential clean energy credit is available for US residents until 2032. Solar panel systems installed in 2033 will only be eligible for a 26% rebate, and the rate will further decrease to 22% for systems installed in 2034. Unless a new law renews the rebate, the residential clean energy credit will stop being offered in 2035.

How much can I save with the federal solar tax credit?

The federal solar tax credit is one of your strongest financial incentives to help you go solar. This tax credit allows you to claim 30% of the total cost of your solar panel system back, making the cost of going solar a bit more affordable. How much you’ll actually be able to save will depend on the cost of your system. To see your savings with the federal solar tax credit, you’ll need to multiply the total cost of your solar panel system by 30%.

Let’s run through an example using California solar panel costs. The average total cost of a 5 kW solar panel system in California is $17,350, according to FindEnergy. To find your savings, multiply the total cost by 30% in its decimal form (0.3).

Example calculation: 17,350 x 0.3 = 5,205

In our example, you could recoup $5,205 from the total cost of your solar system with the federal solar tax credit.

What is covered by the federal solar tax credit?

Even if you’re eligible for the residential clean energy credit, not every piece of clean energy technology benefits from the 30% rebate. In order to claim this credit, the clean energy addition needs to be made to an existing home that you use as your primary residence.

You’ll be glad to know that solar panels and solar batteries are covered by the federal tax credit – here’s all of the equipment you can apply the solar tax credit toward:

- Solar panels

- Other forms of solar, wind and geothermal power generation (such as solar shingles)

- Solar batteries

- Fuel cells

There are other clean energy efficiency upgrades to your home that will instead be covered by the energy efficient home improvement credit included within the IRA. These upgrades might work in tandem to improve the energy efficiency of your solar panel system. The rebate you receive varies based on the improvement.

- Exterior doors qualify for a $250 rebate, with a maximum limit of $500

- Windows, skylights and insulation materials

- Central air conditioners, water heaters, furnaces, boilers and heat pumps

- Biomass stoves and boilers with a thermal efficiency rating of at least 75% qualify for a tax credit of up to $2,000 per year.

- Home energy audits conducted and prepared by a home energy auditor that include a written report from an inspection that identifies the most significant energy-efficient improvements to the household qualify for a $150 tax credit.

The different rebates for the energy efficient home improvement credit can be found here.

Why are some states not solar-friendly?

Depending on where you live, you’ll be battling more than just expensive solar panel costs. Some states actually de-incentivize the installation of solar panels. There are a few reasons why your state might not have the most solar-friendly policies. But the main culprits are likely the utility companies.

Some utilities see solar as a threat to their long-standing business model. Buying electricity from the local utility company to power your home is how things have been for decades. Solar panels change the game, allowing you to produce your own electricity and become your own personal power plant. This lessens your reliance on the power grid and could eliminate your electric bill altogether.

Because some utilities see solar panels as competition, they’ll lobby against policies that make solar more accessible. As power suppliers, utility companies hold a lot of authority, especially in states where a single utility services the majority of the state. Tennessee is the perfect example of this. The Tennessee Valley Authority (TVA) owns and operates 92% of the state’s electricity generating facilities, according to the US Energy Information Administration. Tennessee also happens to be one of the three states in the US that doesn’t have a statewide net metering policy.

Big coal-mining states also tend to view renewable energy in a negative light. Before the mass shutdown of coal-fired power plants in the US, coal used to be quite profitable. States like Wyoming and West Virginia have been the top producers of coal in the US for decades, and have built much of their states’ economies on the mining and shipping of coal to fuel power plants across the country. As the renewable energy generating capacity continues to grow across the US, coal will likely continue to fade into the background.

Frequently asked questions

Which states offer solar incentives?

Just about every state in the US offers some sort of solar incentive. Most states in the US offer net metering programs, allowing you to sell your excess solar energy to the grid. Some states also offer sales or property tax exemptions for solar panel systems.

By far, the most popular incentive is the federal solar tax credit, which you can take advantage of in any state. This tax credit gives you 30% of the total cost of your solar panel system back in tax credits.

What states have the best solar incentives?

New Jersey, New York, Idaho, Illinois, Maryland, Oregon, South Carolina and Texas are a few states that offer some of the better solar incentives out there. Texas has a wide range of incentives and rebates available that depend a lot on where you live. New York, Idaho, Illinois and South Carolina offer some generous tax credits. And Illinois and Maryland offer some decent additional incentives for low-income households, with some Illinois residents even qualifying for a free solar installation.

Are solar panels tax deductible?

The federal solar tax credit allows you to claim up to 30% of the total cost of your solar system back in tax credits.

Read the full article here